What is Transferwise

When & How Many Times I’ve Used Transferwise

From personal experience, I have so far only transferred money four times. But enough to love and trust this service.

- NZD to Euros, once

- NZD to AUD, once

- NZD to USD, twice

(Note: My visa ended in New Zealand and needed to get my money home somehow 😀 )

First things first: Is it safe?

This was the initial question that held me back the first time I needed a transfer and it cost me 140USD doing a bank to bank wire transfer when it could have cost me maybe 10USD. Transferwise is a highly reputable company backed by many large named investors such as one of the founders of Paypal. It’s legit!!!

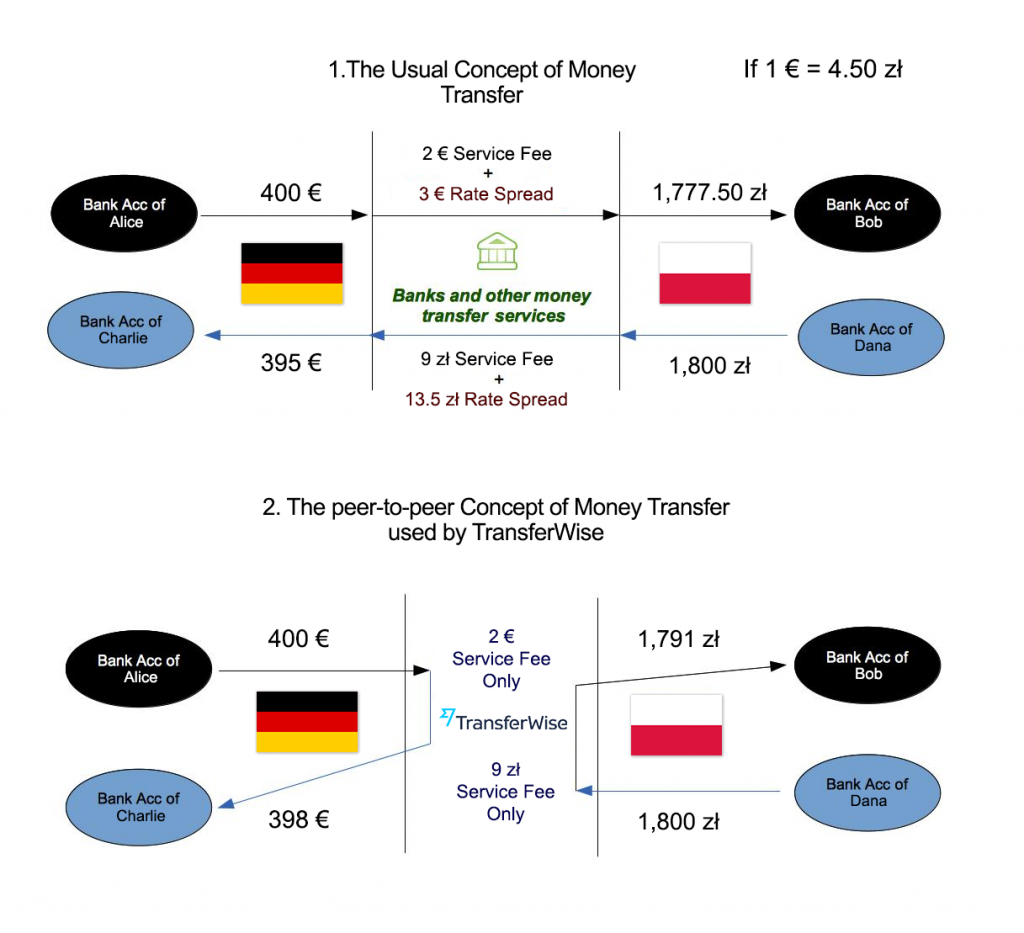

How it Works

Lets say you are a Canadian planning to live about a year in the U.K.. You obviously have a Canadian bank and plan to open a British one. You have your British bank set up but want to have starter funds from home before you start working let’s say (Or you want to buy a car and would be easier to pay with funds in a British account). You send money from the Canadian to Transferwise’s designated temporary bank account for holding. Once Transferwise receives these funds, they will send those funds off to the bank in the U.K..

That’s it!

Currencies Available to Send/Receive

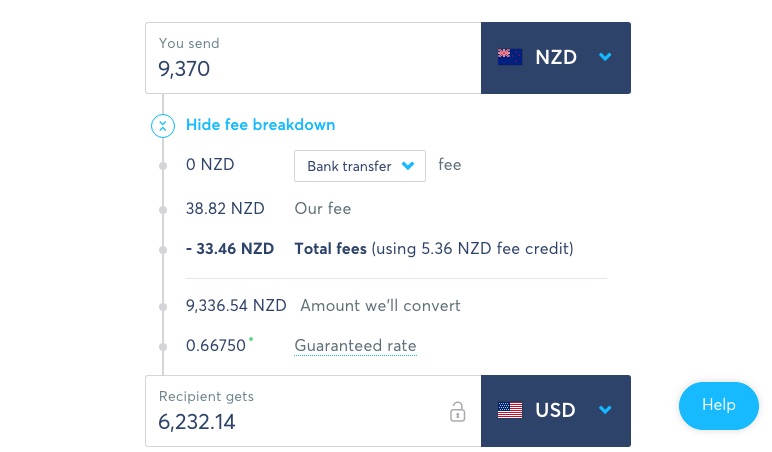

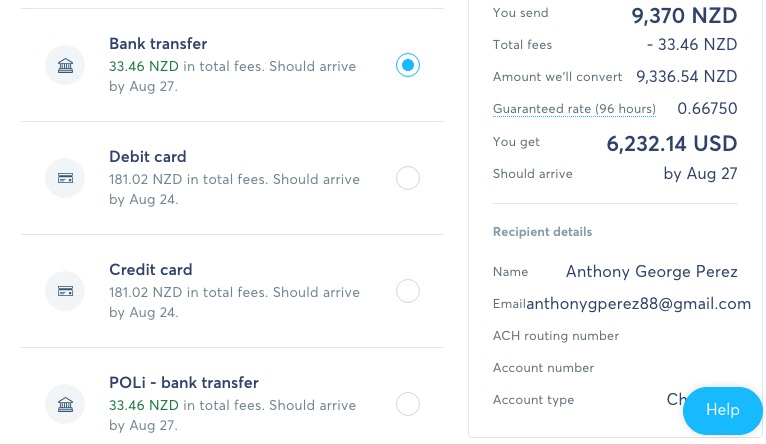

Fee’s and Costs

I cannot simply write what the fees are as they vary but I’ll just say that it’s affordable to use Transferwise in comparison to a bank to bank wire transfer which can be very expensive. In fact I believe it is the cheapest option (Correct me if I am wrong but I am confident on that). Costs are dependent on where you are sending from and where the money is going. Also depends on how you are sending:

- Bank Debit (ACH) – What I’ve Used

- Wire Transfer

- Debit Card

- Credit Card

Note: Before I started using Transferwise, I transferred 2,000 USD to NZ via Bank to Bank wire transfer and cost me $150 USD in fees. I eventually transferred three times more of this back from New Zealand to US and only cost me around $22 USD. INSANE!!!!

(Note 2.0: Xoom is another money transfer service that seems to not have fees. The thing is, Paypal is a rough credibility with scams. Call me biased, but no thanks)

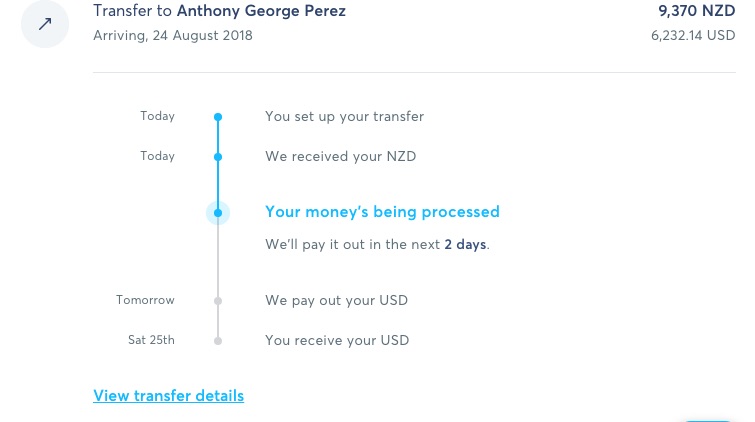

How long it takes?

Time to transfer money can be quick and easy but individual bank institutions can be responsible for longer durations. With that being said, the times I’ve used Transferwise, it took approximately 2-3 days from bank A to bank B. New Zealand to Australia took 2 days to no surprise. And the two from New Zealand to the US took 3 days on one transfer and 5 on the other I think because of the time of day I had sent it.

(Personal Note: The transfer to Euros didn’t matter. As long as the money was sent from me to the captain of the sailboat I was on for 19 days. Had to pay for my usage and stay somehow 🙂 )

Why I Use It

I am a world nomad, and if anything has been the most complicated in my travels, it’s getting my money sorted from border to border. Having lived in New Zealand temporarily and with intentions on living in far flung places whether for a few months to over a year, I now have no fear of having to deal with hurdles and high fees just to have my money. With that being said, Transferwise has become my number one go to platform and resource to get my money from home away from home to…my home home :). It’s fast, cost efficient, reliable, easy to use, and best of all, it’s safe.

If you’re interested in trying out Transferwise, click the image below. This is an affiliate link and any services used through this link will support me in every way.